Freshbooks Review 2025: Revolutionizing Business Finances

Are you searching for a reliable accounting and invoicing software that can simplify your financial management? If you’re a small business owner, freelancer, or solopreneur, FreshBooks might just be the solution you’ve been looking for.

In this FreshBooks Review 2025, you’ll discover how this powerful tool can transform the way you handle invoicing, billing, and accounting. Imagine saving hundreds of hours annually and potentially thousands of dollars in billable hours! With features like professional invoice creation, automated expense categorization, and real-time financial insights, FreshBooks is designed to streamline your processes and give you more time to focus on growing your business.

Whether you’re managing client payments, tracking expenses, or generating financial reports, FreshBooks has you covered. Plus, with a 30-day free trial and a 90% discount for the first three months, you can experience the benefits with minimal risk. Dive into the full review to see how FreshBooks can revolutionize your financial management and help you achieve your business goals. Don’t miss out on discovering why over 30 million small businesses worldwide trust FreshBooks for their accounting needs.

Credit: www.youtube.com

Introduction To Freshbooks 2025

FreshBooks 2025 promises to redefine how small businesses handle finances. It offers a powerful suite of tools for accounting and invoicing. This software is a boon for small businesses and freelancers. It simplifies financial management and enhances productivity.

Overview Of Freshbooks And Its Evolution

FreshBooks started as a simple invoicing tool in 2003. Over the years, it has evolved into a comprehensive accounting solution. Today, it serves over 30 million small businesses globally. The platform integrates over 100 apps for enhanced functionality. This evolution reflects its commitment to user needs and technological advancements.

Key features include:

- Invoicing: Create professional invoices with ease.

- Billing and Payments: Offers options for recurring invoices and online payments.

- Expenses: Manage expenses with mobile receipt scanning and automated categorization.

- Accounting: Provides real-time financial insights and reports.

- Additional Features: Includes payroll, mileage tracking, and client management.

Purpose And Target Audience Of Freshbooks

FreshBooks is designed for small businesses, freelancers, and solopreneurs. It targets those who need efficient financial management tools. The software helps streamline accounting, billing, and invoicing processes. Businesses with employees or contractors benefit from its comprehensive features.

Key benefits include:

- Time Savings: Users can save up to 553 hours annually.

- Financial Savings: Potential to save up to $7000 in billable hours each year.

- Global Reach: Used in more than 160 countries.

- Support: Offers high-quality support with a 4.8/5.0 star rating.

FreshBooks offers a 30-day free trial for new users. It also provides a significant discount of 90% for the first three months. This makes it an attractive choice for small businesses and freelancers.

Credit: www.fahimai.com

Key Features Of Freshbooks 2025

FreshBooks 2025 stands out in the world of accounting software. It offers a suite of features tailored for small businesses and freelancers. The platform is designed to simplify financial tasks, saving time and money.

Enhanced Invoicing Capabilities

FreshBooks 2025 brings enhanced invoicing tools. Users can create professional invoices quickly. Options include adding tracked time and expenses. Tax calculations and customizable payment options are also available. Enjoy efficient billing with recurring invoices and online payments. Automatic late payment reminders ensure timely collections.

Streamlined Expense Tracking

Managing expenses becomes easier with FreshBooks 2025. It offers mobile receipt scanning for quick uploads. Users can import data from bank accounts seamlessly. The software categorizes expenses automatically. This feature reduces manual entry and boosts accuracy.

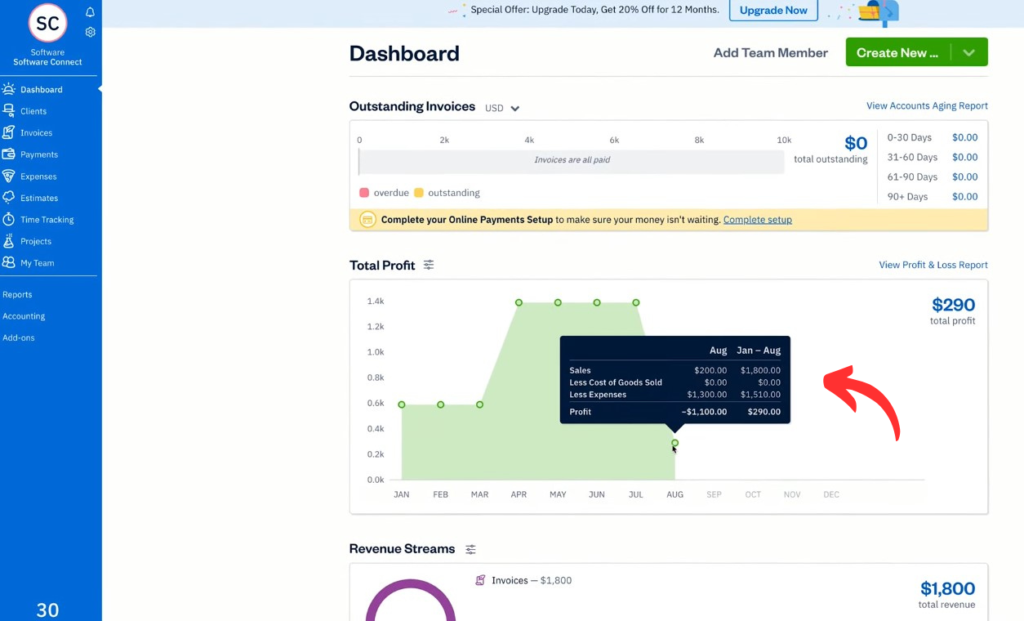

Automated Financial Reporting

FreshBooks 2025 provides real-time financial insights. It uses double-entry accounting tools to ensure precision. Automated financial reports are at your fingertips. These reports help in making informed business decisions. Gain a clearer understanding of financial health.

Integration With Other Business Tools

FreshBooks 2025 integrates with over 100 apps through its AppStore. These integrations enhance functionality and streamline operations. Whether it’s payroll, client management, or bookkeeping, FreshBooks has you covered. This connectivity is vital for comprehensive business management.

Explore these features and more on the FreshBooks website.

Pricing And Affordability

FreshBooks offers flexible pricing plans tailored for businesses of all sizes. Whether you’re a freelancer or a large corporation, FreshBooks has options to fit your budget. Understanding the pricing tiers can help you make an informed decision that aligns with your financial goals.

Pricing Tiers And Options

FreshBooks provides several pricing tiers to accommodate different business needs. Here’s a breakdown:

| Plan | Features | Price |

|---|---|---|

| Lite | Basic invoicing and expense tracking | $15/month |

| Plus | Advanced billing and payment options | $25/month |

| Premium | Comprehensive accounting tools | $50/month |

| Select | Custom solutions for large businesses | Custom pricing |

FreshBooks also offers a generous 90% discount for the first three months. This allows new users to explore features without the full financial commitment. A 30-day free trial is also available.

Cost-effectiveness For Small And Large Businesses

FreshBooks is designed to be cost-effective for businesses of all sizes. Small businesses benefit from streamlined invoicing and expense management, which saves time and money. The Lite plan is perfect for freelancers needing basic tools.

Large businesses can opt for the Select plan, which offers custom solutions. This plan ensures scalability and flexibility, catering to complex accounting needs. Businesses save up to $7000 in billable hours yearly, making FreshBooks a smart investment.

With global support and integration options, FreshBooks enhances functionality. Over 30 million businesses in more than 160 countries trust FreshBooks, proving its reliability and value.

Pros And Cons Of Using Freshbooks

Understanding the benefits and limitations of FreshBooks is crucial for small business owners. This accounting software offers a variety of features to enhance financial management. Let’s explore the advantages and potential drawbacks of using FreshBooks.

Advantages Of Freshbooks For Business Finances

FreshBooks offers a range of features that simplify financial tasks.

- Time Savings: Users can save up to 553 hours annually.

- Financial Savings: Possible savings of up to $7000 in billable hours each year.

- Professional Invoicing: Create invoices quickly with options for tax and expense tracking.

- Automated Billing: Recurring invoices, online payments, and late reminders save time.

- Expense Management: Scan receipts, import bank data, and categorize expenses automatically.

FreshBooks also offers real-time financial insights and double-entry accounting tools. This helps small businesses stay on top of their finances.

With global reach, over 30 million businesses use FreshBooks worldwide. The integration with over 100 apps adds further functionality. A 30-day free trial lets new users explore the software risk-free.

Potential Limitations And Drawbacks

Despite its benefits, FreshBooks has some limitations.

- Refund Policy: The document does not specify refund details.

- Pricing: After the initial discount, costs may increase.

Although FreshBooks offers high-quality support, specific refund policies are not detailed. Users might need to contact FreshBooks directly for further information.

Despite these drawbacks, FreshBooks remains a popular choice for small businesses.

Ideal Users And Use Cases

FreshBooks, a leading accounting software, is perfect for simplifying financial tasks. It’s designed with small businesses, freelancers, and solopreneurs in mind. Whether you have employees or work solo, FreshBooks can streamline your accounting and invoicing processes.

Businesses That Benefit Most From Freshbooks

FreshBooks suits various business models. Here’s a breakdown:

- Small Businesses: Ideal for businesses with limited resources.

- Freelancers: Perfect for managing invoices and expenses.

- Solopreneurs: Helps in tracking time and managing client payments efficiently.

- Teams: Useful for businesses with employees or contractors.

Businesses across 160 countries use FreshBooks to save time and money. Users can save 553 hours annually and up to $7000 in billable hours each year.

Scenarios Where Freshbooks Excel

FreshBooks shines in specific scenarios:

- Invoicing: Create professional invoices quickly. Customize payment options and add tracked time.

- Billing and Payments: Efficient billing with recurring invoices and automatic reminders.

- Expense Management: Scan receipts and automate expense categorization.

- Accounting: Get real-time financial insights with double-entry accounting tools.

FreshBooks integrates with over 100 apps for enhanced functionality. It offers global support with a team of over 100 staff and boasts a 4.8/5.0 star rating.

Credit: www.fahimai.com

Frequently Asked Questions

What Features Does Freshbooks Offer In 2025?

FreshBooks 2025 offers a range of features including advanced invoicing, time tracking, expense management, and project management. It also includes automated payment reminders and integrates with popular tools like PayPal and Stripe. The platform is designed for small businesses, freelancers, and service-based companies.

How User-friendly Is Freshbooks For Beginners?

FreshBooks is highly user-friendly for beginners. Its intuitive interface makes it easy to navigate. The platform offers a simple setup process and provides helpful tutorials. Users can quickly create invoices, track time, and manage expenses without needing technical expertise.

Is Freshbooks Suitable For Freelancers In 2025?

Yes, FreshBooks is ideal for freelancers in 2025. Its features cater to freelance needs, including easy invoicing, expense tracking, and project management. It also offers time tracking and integrates with payment platforms. These tools help freelancers manage their business efficiently.

How Does Freshbooks Handle Expense Tracking?

FreshBooks simplifies expense tracking with easy-to-use features. Users can quickly capture receipts and categorize expenses. The software automatically organizes and syncs expenses with bank accounts. This ensures accurate financial records and simplifies tax preparation, saving users time.

Conclusion

FreshBooks simplifies accounting for small businesses and freelancers. It offers efficient invoicing, billing, and expense management. This tool saves time and money. Users can enjoy real-time financial insights. With a global reach, FreshBooks supports businesses worldwide. The software integrates over 100 apps.

High-quality customer support ensures a smooth experience. Discounts and a free trial make it accessible. FreshBooks is a reliable choice for managing finances. Perfect for those seeking ease in accounting tasks. Explore its features and see the benefits firsthand. Visit their website for more details.